Xxv Figure I7 Indicators of Financial Development. Until August 2016 it was reported that CIMB Group closed 23 branches to minimise operation cost and digital banking services.

Pdf Competition In The Malaysia S Banking Industry Quo Vadis 18 Ijem S3 2017 R2 Competition In The Malaysia Banking Industry

Malaysias three largest banks by assets face growing pressure on profitability from the coronavirus-led downturn Moodys Investors Service said.

. Figure I5 External Trade for Malaysia 20002018 RM Million. The downsizing of many banks in Malaysia is somehow irrelevant to them given the accessibility factor. Theyre still on the mend following the 1997 economic crisis and the fintech -- financial technology -- revolution together with the growing digital banking trend is rewriting how business gets done.

Capital strength to safeguard the integrity and stability of Malaysias financial system in a time of economic challenges amid COVID-19 applicants will need capital funds of minimum RM100m in the foundational phase and RM300m thereafter. The impacts of the pandemic may be directed to the banks in terms of reduced loan growth earnings provisions and liquidity. NPL problems faced by the banking system.

Whats more Malaysian banks are struggling to connect with an emerging millennial population. Banks in Malaysia face a series of challenges. Such a decision was perhaps appropriate to folks in Peninsular Malaysia who have better access to digital banking.

Xxvii Figure I9 Commodity Price and Fiscal Policy in Malaysia. Kuala lumpur sept 29. Bank Negara Malaysia BNM has provided automatic payment moratorium for Retail and SME customers from 1 April 2020 until 30 September 2020.

Bank Negara Malaysia has redirected merchant banks back to the traditional fee-based activities by limiting their loan exposures. Recent Financial Sector Performance The financial sector which suffered losses in 1998 has recovered along with the rest of the economy. Depending on how long the COVID-19 pandemic plays out banks need to start thinking about managing customers concerns beyond the payment moratorium period.

Xxvi Figure I8 Indicators of Education in Malaysia. Financial viability this includes maintaining an asset threshold of no more than RM2b in the. 1 Lack of quality.

Xxiv Figure I6 Indicators for Innovation 20082017. This was because their asset quality was likely to deteriorate from. Empowering the SMEs The SME sector which contributed to 388 of the countrys GDP in 2019 and employs about 10 million workers is negatively affected by the ongoing pandemic.

There are a number of issues. Meanwhile he said the banking sector had actually improved compared to during the Asian Financial Crisis where the non-performing loan ratio in. In fact ESET researchers have analyzed three malicious Android applications targeting customers of eight Malaysian banks.

The researchers discovered that the ongoing campaign had begun in late 2021 with cyber attackers setting up fake websites that look legitimate to entice shoppers into downloading malicious applications. In 19992000 the banking system recorded pretax profits. We have acknowledged the fact that banking has modernized even before the pandemic and even more so afterward from products to onboarding.

This is proving to be an unlikely catalyst and a further business case on the opportunities for future digital banks in Malaysia. Current issues faced by malaysian banking The Malaysian Financial System Download Table Aibim 2 Local Bank Under Constraints But In Position Of Strength To Recover Daily Express Online Sabah S Leading News Portal Banks In Malaysia Overview Guide To Top Banks In Malaysia Pdf Competition In The Malaysia S Banking Industry Quo Vadis 18 Ijem S3. Xxix Figure 21 Bank Market Risk ES Yearly Mean Results.

What is the current issues faced by the Malaysian banking system. Digital technology has increased competitiveness and contestability in banking industries and traditional payment and banking processes have been disrupted. Moreover the banks may encounter a critical challenge in relocating their newly designed distribution channels due to the introduction of social distancing and compliance functions.

Bank negara malaysia bnm said that while recovery prospects for the malaysian economy remain subjected to some degree of covid-19 pandemic-driven uncertainty the domestic financial system is expected to remain resilient against potential economic and financial shocks as banks and insurers continue to have sufficient. Customer relief and remediation. The direct reasons for the prob-.

The Malaysian banking sector has played a leading role in indirect financing while experiencing problems similar to those of other Asian countries suffering from the financial crisis.

Factors Influence Development Of E Banking In Malaysia Open Access Journals

The Malaysian Financial System Download Table

Pdf The Efficiency Effects Of Mergers And Acquisitions In Malaysian Banking Institutions

The Malaysian Financial System Download Table

Malaysians Say Country S Financial Sector Has A Good Reputation Bebasnews

Digital Banking How Does It Impact The Malaysian Economy

Malaysian Households During Covid 19 Fading Resilience Rising Vulnerability

Pdf Employee Retention In The Malaysian Banking Industry Do Flexible Practices Work

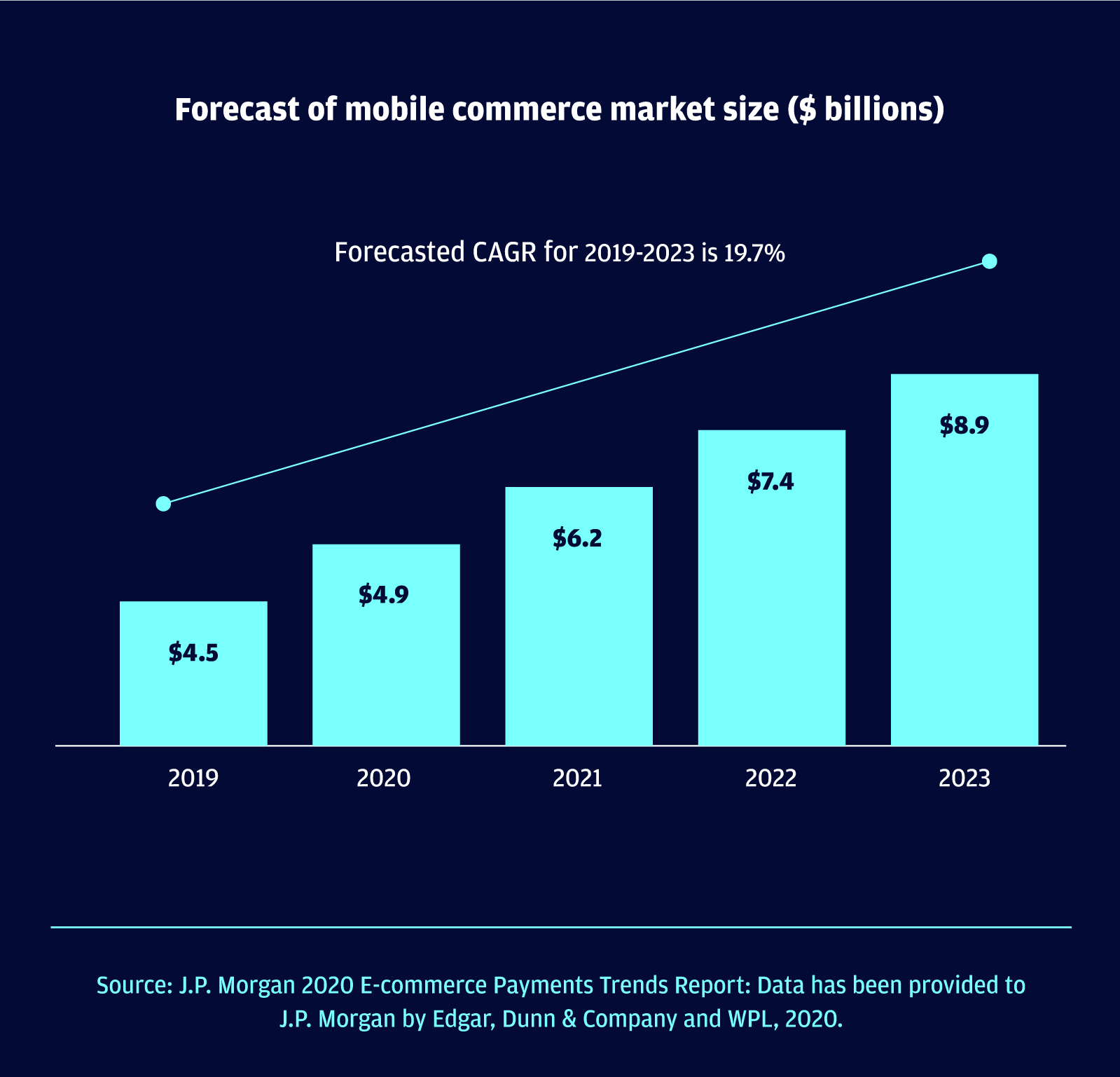

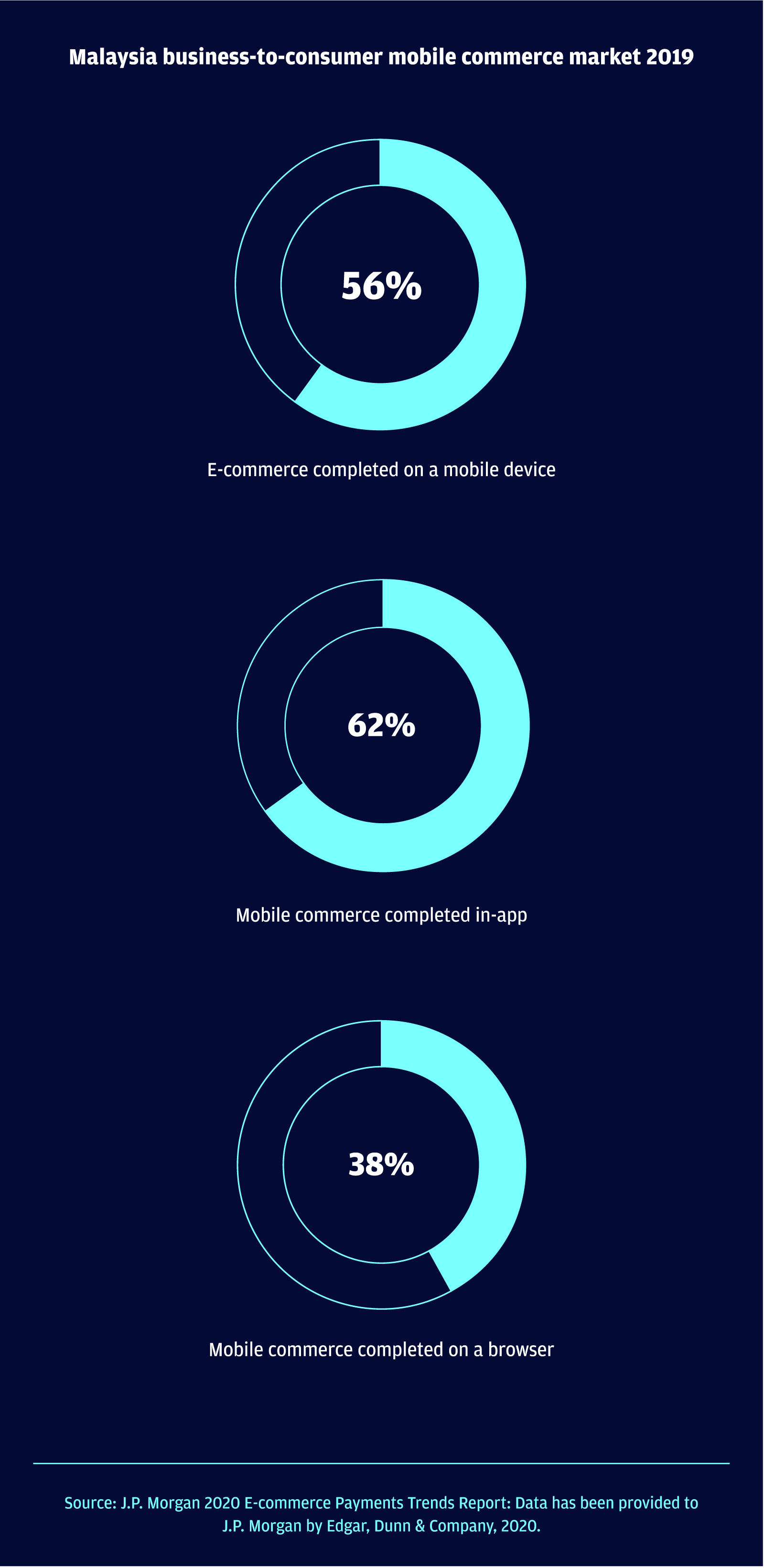

2020 E Commerce Payments Trends Report Malaysia Country Insights

Factors Influence Development Of E Banking In Malaysia Open Access Journals

Factors Influence Development Of E Banking In Malaysia Open Access Journals

2020 E Commerce Payments Trends Report Malaysia Country Insights

Covid 19 Impact On The Banking Sector Kpmg Global

Bank Negara Malaysia Set To Implement Consumer Credit Law Central Banking

Accelerating Esg Integration In Malaysian Banks

2020 E Commerce Payments Trends Report Malaysia Country Insights

Impacts Of Covid 19 On Firms In Malaysia Results From The 2nd Round Of Covid 19 Business Pulse Survey